A set of pivotal events defined the first civil war that raged on in the Bitcoin community, its' largest test as a decentralized network.

The Blocksize War was a debate about the size of Bitcoin's blockchain blocks that took place between 2015 and 2017.

While one side (small blockers) argued that blocksize needs to remain small to give end users the easy option to run a node and therefore have a more decentralized system, the other side (big blockers) wanted to have cheaper transactions and establish Bitcoin as a payment system through larger blocks.

The war turned out to be more about control than the actual blocksize. While the big blocker solutions Bitcoin XT, Classic, and Unlimited failed, Bitcoin Cash and SV are still around today.

Due to the activation of the SegWit soft fork and the overwhelming majority in terms of market share, hash rate and number of network nodes - the small blockers Bitcoin is seen as the winner of the war.

The main argument

Let’s head into a bit of an overview before we chronologically walk through the events, the people involved, and the arguments for each side.

Blocks are groups of bitcoin transactions which are confirmed and broadcasted to bitcoin’s public ledger, the blockchain.

The Bitcoin block size limit is a parameter in the Bitcoin protocol that limits the size of Bitcoin blocks, and, consequently, limits the number of transactions that can be confirmed on the network. As of today, the network can process approximately 7 transactions per second.

The hardcoded block size limit (1MB) was introduced by Satoshi as a way to keep the blockchain small in its early days.

Due to the fact that Satoshi Nakamoto never publicly stated why the 1MB block size limit was added, many have speculated this was done as an anti-spam measure, preventing bad actors from spamming the Bitcoin network with artificially large Bitcoin blocks full of bogus transactions.

As the Bitcoin network grew, and blocks started filling up, a few key questions arose in the Bitcoin community.

- Should blocks be full or consistently have a surplus capacity?

- Should the protocol rules concerning blocksize change easily or be robust and only change if the vast majority wants them to change?

- What is the significance to run a node as a normal user?

- Should Bitcoin prioritize gaining market share quickly in a start-up fashion or focus on the long-term where you need to think decades ahead to make decisions?

The answers to these questions split the Bitcoin community into two groups:

Big blockers - short term prioritization, user experience, growth, business-focused.

Small blockers - long term prioritization, system resilience, sustainability, scientific & theoretical.

Larger blocks initially sound good because more and cheaper transactions sound like a net positive. But there are multiple drawbacks:

- Larger blocks lead to larger blockchains that make it harder to run a node for the average user. This means fewer nodes and thereby less decentralization.

- Transaction fees are necessary, as the block subsidy gets lower and lower, to incentivize the miners.

- It's a protocol rule change. We will later see why the robustness of the existing rules is one of the most important elements of Bitcoin, if not the most.

The Bitcoin XT fork

The first, but certainly not the last proposal by the big blockers, argued that Bitcoin needed bigger blocks to keep transactions cheap came in the form of Bitcoin XT.

It was a suggestion that would increase the blocksize from 1MB to 8MB and then doubling every two years until 2036, where the blocksize would be around 8GB. This software update would be incompatible with existing nodes, which means it's a hard fork. A widening instead of tightening of the existing protocol rules.

Bitcoin XT was created by Mike Hearn and gained traction after Gavin Andresen said he supported it, which was crucial.

When Satoshi, the creator of Bitcoin left the project in 2011, Gavin Andresen sort of became the "leader" of the Bitcoin project as Satoshi asked him if he can put Gavin’s email address on the bitcoin homepage.

I was the person everyone would email when they wanted to know about bitcoin. Satoshi started stepping back as leader of the project and pushing me forward as the leader of the project. - Gavin Andresen

Gavin was very well respected in the community and seen as the main guy. He was also the first paid Bitcoin developer. This gave Bitcoin XT a lot of credibility and the large blocker camp certainly had the lead when it came to social media presence and sentiment at the time.

In general most of the posts were in support of the larger blocks. The larger block message was clear and simple: Bitcoin needed more capacity. To the casual observer, the arguments against this were, typically, highly complex and somewhat confusing. And on top of this 1 MB just seemed like a low number and the history of computer science was about capacity growing exponentially. - Jonathan Bier

At first, there actually was no blocksize limit. Satoshi introduced a 1 MB limit in the summer of 2010 without any comment or explanation which was quite typical for him.

The reason probably was that blocks larger than 32 MB could have broken the system at this point. However, there is no indication that the 1 MB limit was a permanent solution that Satoshi sought.

Satoshi made many comments during the first two years of his involvement in the space, many of which could be said to support either side in this war. In general, it could be said that the quotes indicate that Satoshi seemed to broadly support the large blockers with respect to the narrow issue of the blocksize limit and transaction throughput, but Satoshi seemed somewhat supportive of the smaller block position with respect to their view on the flexibility of the Bitcoin rules. - Jonathan Bier

In 2015 Satoshi once again engaged in the Blocksize war with one email. Many suspect that his email account was hacked, but if it was him or not, the message is important.

Bitcoin was designed to be protected from the influence of charismatic leaders, even if their name is Gavin Andresen, Barack Obama, or Satoshi Nakamoto. Nearly everyone has to agree on a change, and they have to do it without being forced or pressured into it. - Satoshi (allegedly)

This is a very key point and dismantles the argument that if it was Satoshis’s vision to have big blocks, then we should have big blocks.

It's not known if he changed his mind during the discussion with more and more information available and it doesn't matter either. If he could decide protocol rule changes, Bitcoin would be a failed project.

If two developers can fork Bitcoin and succeed in redefining what "Bitcoin" is, in the face of widespread technical criticism and through the use of populist tactics, then I will have no choice to declare Bitcoin a failed project. - Satoshi (allegedly)

Big blockers wanted blocks that are not full so that transactions remain cheap. Small blockers were convinced that full blocks are necessary for the long term anyway.

If there is no surplus of transactions, there is no fee bidding. Due to the block reward halving every 4 years the miners would have less and less of an incentive to mine blocks in case there are no transaction fees.

This is known as a fee market death spiral. Here again, you can see how small blockers thought decades ahead and preferred sustainability instead of faster adoption.

The debate goes global

During the blocksize war, there were several conferences held around the world that discussed the subject of scaling.

First in Montreal, then in Hong Kong where it became clear that an 8 MB blocksize increase is not the right move forward and Bitcoin XT was basically dead. An increase to 2 MB was still on the table.

I thought about the immense pressure which would be exerted on Bitcoin by major economic and political players as Bitcoin grows. It would make what Mike and Gavin were doing look minuscule by comparison. I began to realise that the rules of the network had to be robust. It doesn't matter who is trying to change the rules, or whether it's a good idea or not. - Jonathan Bier

And this is a key realization. Bitcoin succeeds because it proves its inability to change. It just exists whether you like it or not and you can't control it or change the rules to your liking.

Introducing a change lead by two people who want to exert control would lead to more changes by individuals that simply shouldn't happen. It has to be really difficult to change a rule.

It reminded me of a quote from Winston Churchill: "Democracy is the worst form of government, except for all the others." Perhaps a system in which the status quo rules prevail, unless there is overwhelming consensus for change, is the worst form of Bitcoin governance - except for all the others. - Jonathan Bier

SegWit and the Lightning Network

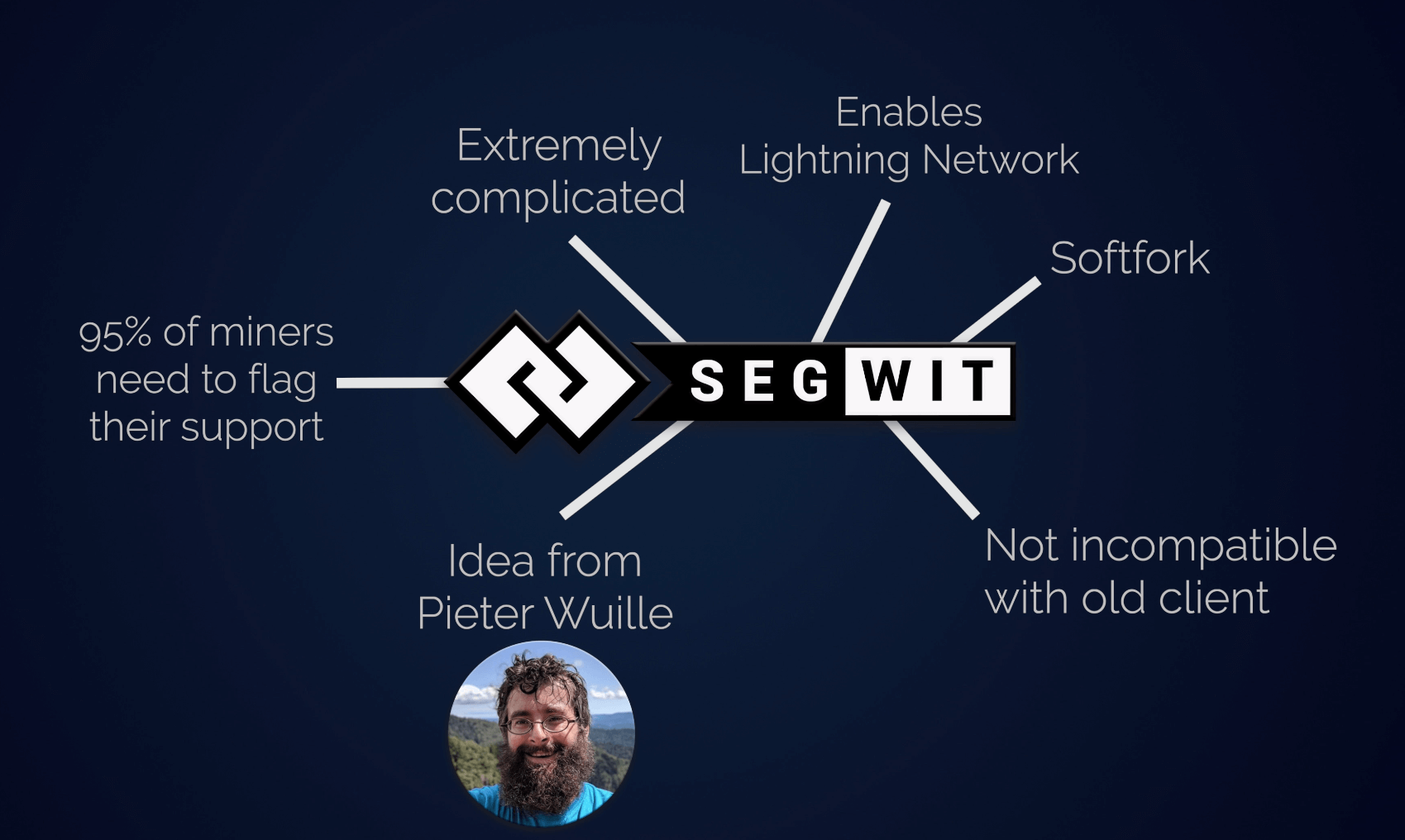

What made the war really interesting is that Bitcoin developer Pieter Wuille found a way to increase the blocksize through a soft fork rather than a hard fork. This means the new client is not incompatible with the previous client. The solution is called Segregated Witness or SegWit for short.

This meant that the signature data received a discount in calculation, but the overall limit would be round 2 MB, which is of course what many people seemed to want: a blocksize limit increase to around 2 MB. - Jonathan Bier

The proposal was simply so good there were no valid arguments against it. - Jonathan Bier

This was a huge step forward for the small blockers who didn't want a hardfork and a potential associated chain split to happen. The problem was that SegWit was extremely complicated. Not every developer understood it.

This is a reoccurring theme - the small blockers had the most technically complicated ideas that are not easy to communicate and often misunderstood.

To make SegWit a reality it first had to be developed and then 95% of miners (an overwhelming majority) need to signal support for SegWit to activate it. This is the same with the recent Taproot update that is now locked in with a 99% support and will activate in November 2021.

Another advantage of the SegWit softfork was that it enabled the Lightning Network, a transaction scaling solution that doesn't involve larger blocks.

In Lightning you don't broadcast a transaction to everyone, but just to the peer you want to transact with over a few routes through a payment channel. If you close a payment channel there is a final settlement over the blockchain. This means you can have an infinite amount of lightning transactions within a single blockchain entry.

And this makes sense for normal payments, because "If someone buys a coffee in France using Bitcoin, why should a merchant selling concert tickets in Japan need to examine that transaction?" - Jonathan Bier

The rising fees due to higher demand and small blocks drove merchants away. This was frustrating to the big blockers which were more focused on the business side of Bitcoin.

However, to the smaller blockers, Bitcoin was not a business, nor a payment system taking on VISA, Paypal and Mastercard. It was a new form of money, something far more ambitious and potentially far more transformational to society and the economy. [...] In general, small blockers had nothing against Bitcoin becoming a fast and cheap payment system; it just came second behind their main priority, which was a robust and new form of money. - Jonathan Bier

Mike Hearn's ragequit and the emergence of Bitcoin Classic

In January 2016, Mike Hearn, the Bitcoin XT developer was so frustrated with the progress of the debate, that he claimed Bitcoin was a failed project and that he will sell all his coins.

After he ragequitted he was somewhat replaced by Jihan Wu the co-CEO of Bitmain, which produced mining equipment and ran mining pools.

After Bitcoin XT was pronounced dead, a new proposal on the big blocker side emerged: Bitcoin Classic, which was supported by a few industry players including Coinbase.

Bitcoin Classic was growing in popularity however had massive weaknesses when it came its activation, that was only understood by really technically adept people.

Bitcoin appeared to me to be heading into a major crisis and split. At this point in the war, the larger block side were in a stronger position than they had ever been, while the smaller blockers still had some tricks left up their sleeves. Bitcoin felt on the brink of a catastrophic failure. - Jonathan Bier

Craig "Faketoshi" Wright

After Jihan Wu another player entered the game: Craig Wright.

Craig Wright, who is a big blocker, claimed that he was Satoshi Nakamoto. Gavin Andresen also stated publicly that he has seen cryptographic proof for this claim.

This is the point where many things went downhill for the big blockers. A lot of them believed in Faketoshi even though it was quite obvious that he is a con artist.

When questioned about aspects of the Bitcoin protocol he didn't have the adequate technical knowledge. He also wrote a long blogpost explaining why he is Satoshi instead of simply proving it with a signature from Satoshi.

Gavin Andresen explained why he believes that Craig Wright is Bitcoin creator Satoshi Nakamoto at Consensus 2016, and lost a lot of credibility through this incident.

This whole scandal had been a major blow to Gavin's reputation and a huge win for the small blockers. Gavin had given the larger blocker side a major, self-inflicted wound and he had nobody to blame for this but himself. - Jonathan Bier

Almost in parallel, a second incident that helped the small blockers vision: The Ethereum DAO hack.

After someone stole 3.6 million Ether ($60M at the time and 15% of the total Ether supply), the funds held by the DAO, the Ethereum foundation decided to reverse the chain state, causing a hardfork, restoring all user funds.

What happened after was Ethereum split into Ethereum and Ethereum Classic, with Ethereum Classic choosing to maintain the original unforked blockchain. And while the hardforked Ethereum is multitudes bigger than Ethereum Classic today, the latter is also still around.

This was a precedent of what could happen when Bitcoin does a hardfork, which terrified the miners. Bitcoin Classic wouldn't replace Bitcoin. There would be a split and both would co-exist.

Bitcoin Classic now looked unlikely to activate in the short term. Ironically, although most small blockers won't like to admit this, Ethereum may have saved Bitcoin. - Jonathan Bier

Bitcoin Unlimited enters the chat

Unfortunately, people have short memories in this space. So what happened? Bitcoin Classic lost traction and the big blockers came up with a new idea: Bitcoin Unlimited.

The problem with Bitcoin Unlimited was that next to the blocksize limit, they wanted to change other things which resulted in a deeply technically flawed project and a less simple communication. At this point the war got more and more heated, people were losing patience and the tension in the community had elevated.

The focus now shifted to the idea that the larger blockers would move over to Bitcoin Unlimited and then also attack the original, smaller blockchain by mining empty blocks and orphaning any blocks with transactions in it. - Jonathan Bier

Jihan Wu and Gavin Andresen allocated a budget of $100m for this attack.

It may not be necessary to attack it. But to attack it is always an option. - Jihan Wu

Preventing a minority-hashrate fork from confirming any transactions is a good idea. - Gavin Andresen

The next key impact on the blocksize war was the exchange Bitfinex listing futures contracts for Bitcoin Unlimited vs. Bitcoin Core.

The big blockers always thought they would win once the market can decide which Bitcoin is the better one. Well it turns out they were wrong in that assumption.

The Bitcoin Unlimited Token never reached more than 20% of the price of Bitcoin. Ultimately, at the end of 2017, the Bitcoin Unlimited token expired worthless, so no Bitcoin Unlimited-related chain-split occurred.

So to have a short recap here: Bitcoin XT failed, Bitcoin Classic failed and Bitcoin Unlimited failed as well.

Remember, for SegWit to activate a 95% miner activation threshold was necessary. This was very unlikely at the time.

For comparison, the recent Taproot update that is now locked in had the same activation threshold and gained a 99% support. It will activate in November 2021.

Litecoin as a SegWit test run

Next to Bitcoin there was Litecoin which only had a 75% activation threshold. The small blockers discussed that Litecoin could actually be a good test run for SegWit.

The Litecoin community embraced the softfork with open arms because it meant that Litecoin became one step ahead of Bitcoin development. But of course the same debate about big and small blocks now migrated over to Litecoin as well.

Regardless, SegWit activated on Litecoin in May 2017.

This whole incident also lead to a new strategy. The UASF: User Activated Softfork.

This means that users who run a node can signal for SegWit instead of miners needing to signal. These nodes don't accept non-SegWit blocks from miners, so if a sufficient amount of nodes signal for SegWit the miners will have to update to SegWit as well, otherwise their blocks will get rejected.

So far no USAF was used, but knowing that this works shows that the miners don't have ultimate power over the network. Bitcoin nodes do, and thereby the end users do.

The war reached a new height with the New York Agreement shortly after.

The New York Agreement

On May 22, 2017 there was a closed doors meeting in New York with people like Barry Silbert and Jihan Wu. The agreement was about how Bitcoin should move forward from here and contained the following.

- Activate Segregated Witness at an 80% threshold, signaling at bit 4

- Activate a 2 MB hard fork within 6 months

This was supposed to resolve the conflict by doing a softwork and a hardfork. Basically one thing for the smaller blockers and one for the larger blockers. What it really was, was an attack by institutions on the Bitcoin network.

As for the small blockers, there was no representation of them in New York and their views were not reflected in the agreement whatsoever. [...] Notably, the agreement made no reference to the idea that Bitcoin users control the protocol or that support of the users was necessary before changing the rules. The NYA did not even pay lip service to the idea that users should have a say. It was pitched as the large corporates in the space imposing the rules on the users in a top-down manner. [...] It felt like a threat or an ultimatum. - Jonathan Bier

The first part of the agreement - SegWit - was a complete mess during the activation period.

Miners were flagging all over the place and at the wrong bits or indicating they run a client that didn't even exist yet. Software updates like this have given Bitcoiner's PTSD ever since.

However SegWit did end up activating on Bitcoin. Something that was almost unthinkable for a long period of the blocksize war.

Towards the end of July 2017, Bitmain finally flagged for bit 1, just a few days before the deadline. The small blockers were ecstatic. After a grueling campaign, more than 10 months after SegWit was released, the largest miner in the space had finally flagged support for it. - Jonathan Bier

Why? Because of the threat of a user activated softfork. This was a tremendous David vs. Goliath victory.

SegWit activated, but this was only part one of the New York Agreement.

The second part was the hardfork to a 2 MB blocksize limit, known as the 2X of the SegWit2x proposal. Many industry players didn't want this to be a different coin, it was supposed to be Bitcoin in their eyes.

However more and more large blockers got the feeling that this part of the agreement will fail, so they started to think of new solutions. After Bitcoin XT, Classic, and Unlimited a new coin was on the horizon: Bitcoin Cash.

Bitcoin vs Bitcoin Cash

At this point, another notable name participated in the war: Roger Ver. To say Roger Ver was excited about Bitcoin is an understatement

When he first discovered Bitcoin, Roger is said to have been so excited by the opportunity that he was hospitalised for several days. - Jonathan Bier

But who is he? In the early days, Roger was one of the most relentless promoters of Bitcoin and was most intrigued in the payments aspects of the network. In the ensuing block size war, this made him a big blocker. He was also the owner of the Bitcoin.com website.

If the 2X portion of Segwit2x fails to activate, Bitcoin.com will immediately shift all company resources to supporting Bitcoin Cash exclusively. - Roger Ver

And Bitcoin Cash happened. In fact, it launched just one month after the genesis of the idea.

In parallel, some supporters of the New York Agreement began to withdraw from it because the implementation wouldn't have replay protection which created an attack vector.

The large blockers never really supported SegWit2x, their hearts went to Bitcoin Cash. SegWit2x did not have support from the users. It had no node network; with almost everyone running Bitcoin Core, the exchanges either rejecting SegWit2x or taking a neutral stance. [...] SegWit2x was dead in the water. The small blockers looked set for a sensational victory. It was no longer a question of if, but when. - Jonathan Bier

Bitcoin's victory

The 2x part failed and was never implemented. Bitcoin Cash exists to this day but doesn't come close to Bitcoin in its market share or hashpower.

On Wednesday, November 8, 2017, an email was sent to the SegWit2x mailing list explaining that phase two of the New York Agreement was officially abandoned.

The war was over and the small blockers won.

However not everyone agreed. Some people, particularly some of the large blockers, interpreted the war as a battle between Bitcoin Core and the miners. In their minds, Bitcoin Core had won and the miners had lost, therefore Bitcoin Core developers now controlled Bitcoin. [...] In some people's minds, the idea of a system controlled by end users is too difficult to grasp. Instead they look for somebody or some entity who controls the system. - Jonathan Bier

The future of Bitcoin

If Bitcoin is able to scale as a payment system is still left to be seen. Lightning is just a few years old and getting consistently better. The El Salvador Bitcoin adoption will be a good experiment to see how far Lightning has come. As always, the small blockers are not in a rush.

This won't be the last Bitcoin war. The next one will probably be about regulations, privacy, and censorship resistance.

However, at least for now, the dream of a world where ordinary people have ultimate and direct control over the rules that govern their money, lives on. - Jonathan Bier

12 minute read

12 minute read